Table of Contents

- 2025 Irmaa Brackets Part B - Megan Butler

- What IRMAA bracket estimate are you using for 2024? - Bogleheads.org

- 2025 IRMAA Brackets & TSP Contribution Limits Explained.

- Medicare Irmaa Brackets For 2025 Images References : - Isadora Blake

- Medicare Cost 2025 Irmaa Brackets - Robert Reid

- Irmaa Brackets 2025 Part B - Ameen Sanaa

- Irmaa 2025 Part D - Madge Ethelda

- 2025 Irmaa Brackets And Premiums - Lara Clara

- 2025 IRMAA Brackets & TSP Contribution Limits Explained.

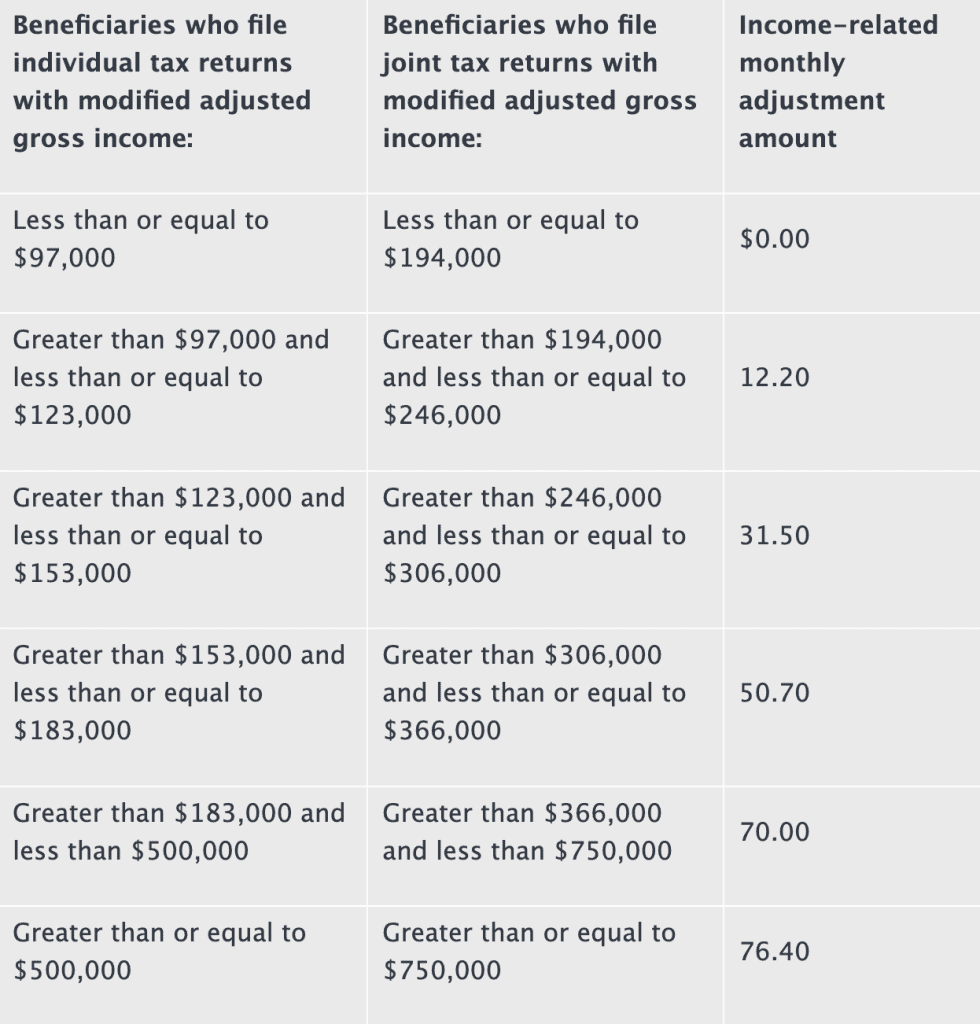

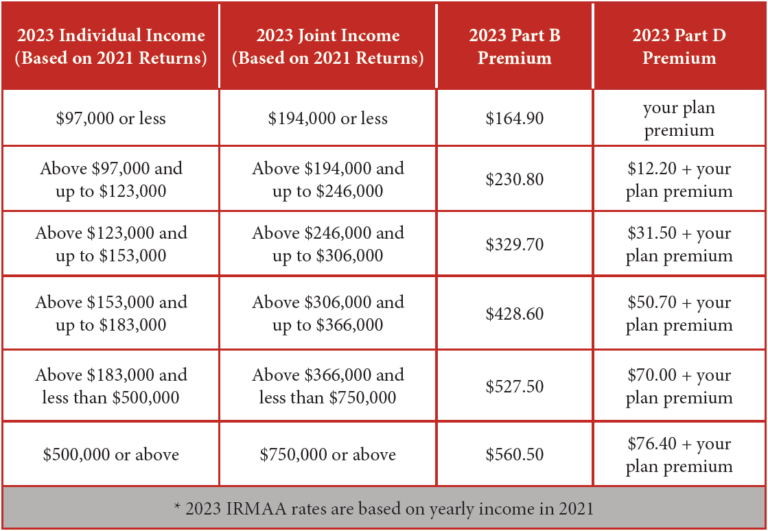

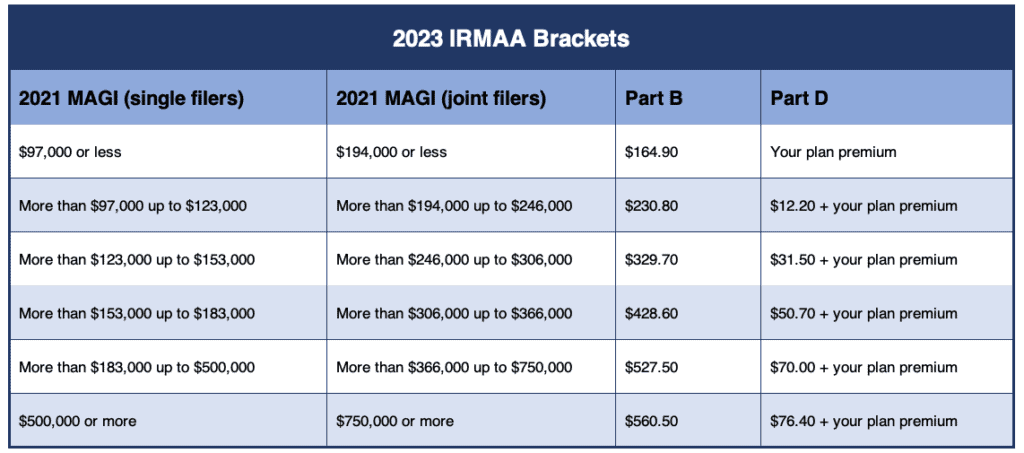

- The 2023 IRMAA Brackets - Social Security Intelligence

What is IRMAA and How Does it Affect Medicare Part B Premiums?

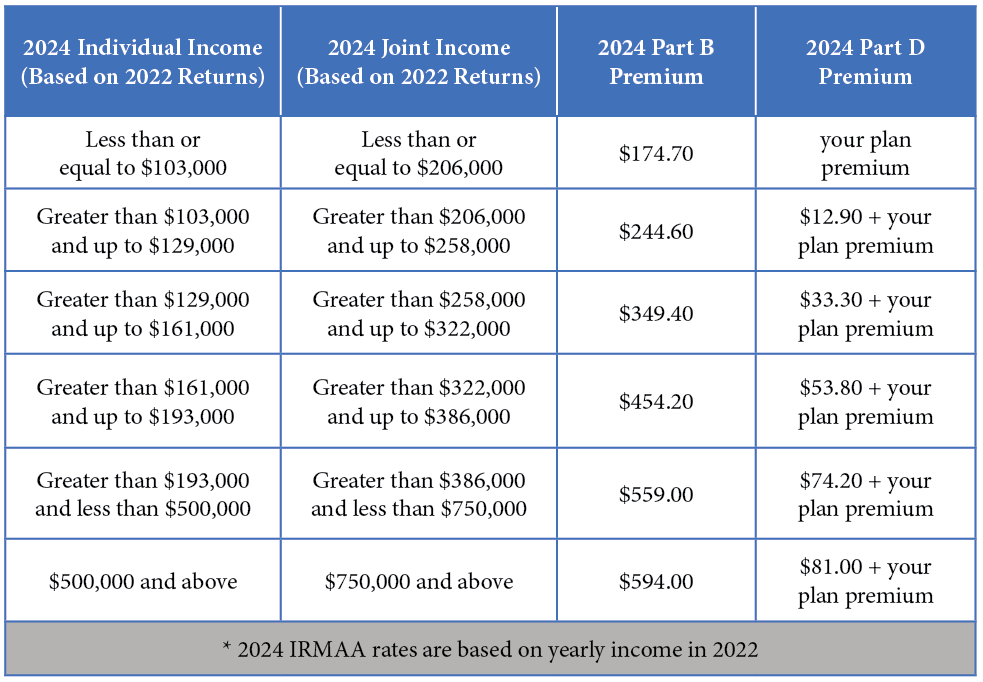

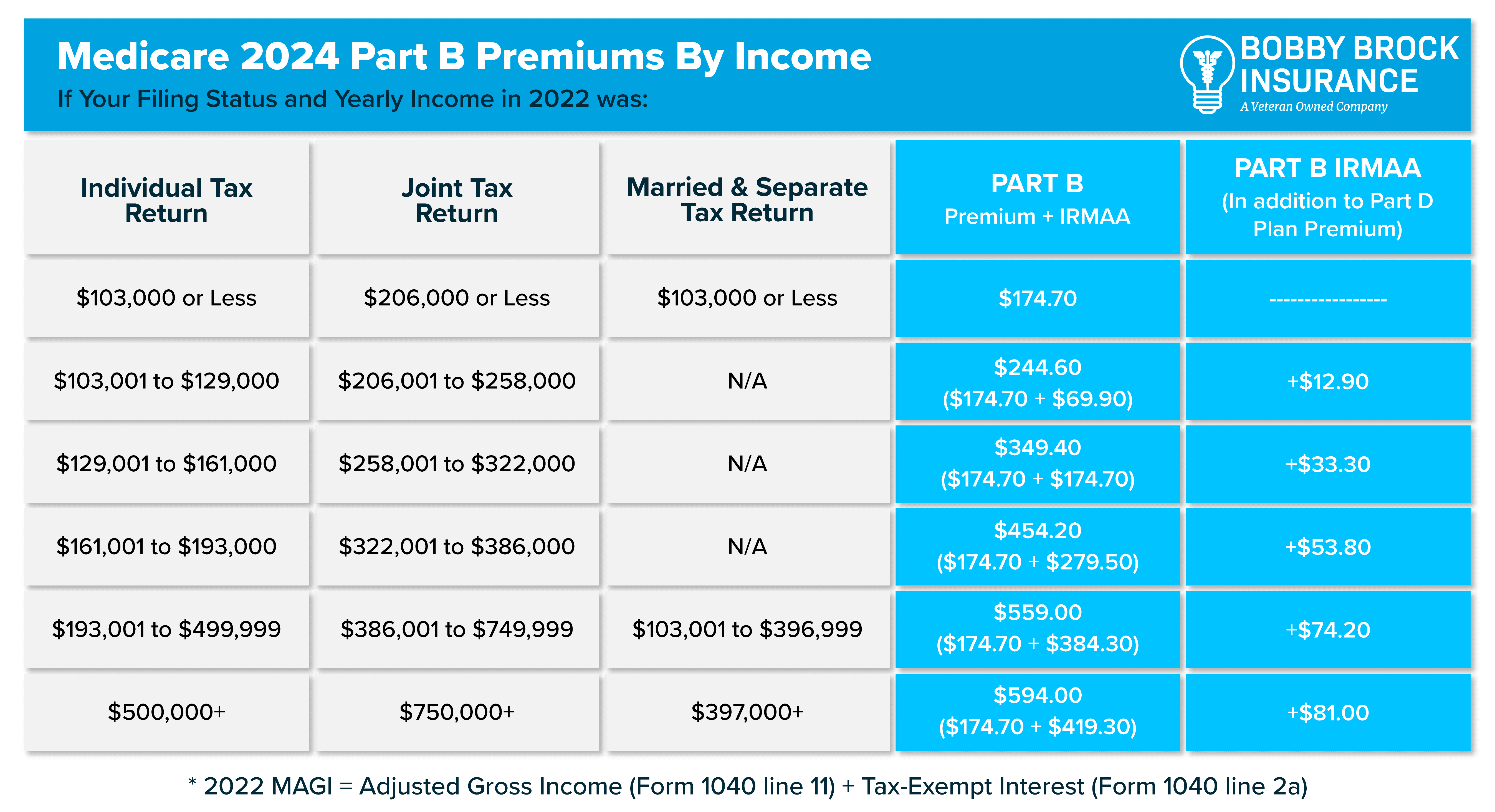

2025 IRMAA Part B Premium Brackets

Obtaining Affordable Insurance from Anywhere

With the rising costs of healthcare, it's essential to explore options for affordable insurance. Fortunately, there are various ways to obtain insurance from anywhere, including: Medicare.gov: The official Medicare website provides a wealth of information on Medicare plans, including Part B premiums and IRMAA. HealthCare.gov: The Health Insurance Marketplace offers a range of health insurance plans, including those that complement Medicare. Private insurance companies: Many private insurance companies offer Medicare Supplement Insurance (Medigap) and Medicare Advantage plans.

Tips for Reducing Your IRMAA Part B Premiums

While the IRMAA is based on your income from two years prior, there are ways to reduce your Part B premiums: Consider consulting a tax professional to optimize your income and reduce your MAGI. Explore Medicare Advantage plans, which may offer lower premiums and additional benefits. Look into Medigap plans, which can help supplement your Medicare coverage and reduce out-of-pocket costs. In conclusion, understanding the 2025 IRMAA Part B premiums is crucial for individuals and couples who want to navigate the complex world of Medicare. By exploring options for affordable insurance and reducing your IRMAA, you can ensure that you have access to quality healthcare without breaking the bank. Remember to stay informed about changes to Medicare and IRMAA, and don't hesitate to seek guidance from a licensed insurance professional or a trusted resource like Medicare.gov.For more information on 2025 IRMAA Part B premiums and affordable insurance options, visit Medicare.gov or consult with a licensed insurance professional. Stay ahead of the curve and take control of your healthcare costs today!